| Key Takeaways |

|---|

| 1. Explanation of the 50/30/20 budget rule |

| 2. Benefits of adopting this budgeting method |

| 3. How to effectively implement the 50/30/20 rule in your financial planning |

| 4. Common challenges and solutions in following the 50/30/20 budget |

In an era where financial security is more crucial than ever, understanding and implementing effective budgeting strategies is key to maintaining a healthy financial life. Among the plethora of budgeting methods available, the 50/30/20 rule has emerged as a simple yet effective approach to managing personal finances. This article delves into every facet of the 50/30/20 budget, providing a comprehensive guide to those seeking financial stability and growth.

What is the 50/30/20 Budget?

At its core, the 50/30/20 budget is a method of allocating your after-tax income into three distinct categories: Needs, Wants, and Savings. Here’s how it breaks down:

- 50% Needs: This half of your income covers essential expenses, such as rent, groceries, utilities, and transportation.

- 30% Wants: This portion is allocated for non-essential expenses, including dining out, entertainment, and hobbies.

- 20% Savings: The remaining fifth of your income is directed towards savings, debt repayment, and investments.

This budgeting framework is celebrated for its simplicity and adaptability, making it suitable for a wide range of income levels and lifestyle needs.

Benefits of the 50/30/20 Budget

Adopting the 50/30/20 budget can lead to several benefits:

- Simplicity: Its clear-cut categories make it easy to follow and maintain.

- Flexibility: It can be adjusted according to personal financial goals and life changes.

- Financial Responsibility: It encourages a balanced approach to spending and saving, promoting long-term financial health.

Implementing the 50/30/20 Rule in Your Financial Planning

To effectively use the 50/30/20 budget, start by calculating your after-tax income. Then, categorize your expenses into ‘Needs’, ‘Wants’, and ‘Savings’. Tracking your spending in these categories over a few months will give you a clear picture of your financial habits and areas for improvement.

Challenges and Solutions

While the 50/30/20 rule is straightforward, implementing it can be challenging. Common issues include:

- Overestimating ‘Wants’ and underestimating ‘Needs’.

- Difficulty in saving the designated 20% of income.

- Adjusting the budget to cope with financial emergencies or changes in income.

Solutions to these challenges involve:

- Rigorous categorization and tracking of expenses.

- Gradual adjustments to reach the desired allocation percentages.

- Creating a contingency plan for financial uncertainties.

Customizing the 50/30/20 Budget for Various Financial Situations

No two financial situations are the same, and the beauty of the 50/30/20 budget lies in its adaptability. Whether you’re a student, a working professional, or nearing retirement, this budget can be tweaked to fit your unique financial landscape.

For Students and Young Professionals

- Adjusting the ‘Needs’: Students may have lower ‘Needs’ expenses due to shared housing or campus facilities.

- Increasing ‘Savings’: Young professionals might focus more on savings for future investments like home buying or starting a business.

For Established Professionals

- Balanced Allocation: With a stable income, maintaining the standard 50/30/20 split can ensure a healthy balance of enjoyment and financial responsibility.

- Focus on Retirement Savings: A larger portion of the ‘Savings’ can be directed towards retirement funds.

For Retirees

- Shifting Focus to ‘Needs’: Increased medical expenses or assisted living costs might require a higher allocation to ‘Needs’.

- Managing ‘Wants’ on a Fixed Income: Retirees can enjoy leisure activities while keeping an eye on their budget.

Real-Life Examples and Tips

Consider John, a young professional earning $3,000 monthly. After taxes, his take-home pay is $2,400. According to the 50/30/20 rule:

- $1,200 (50%) should go towards ‘Needs’ like rent and groceries.

- $720 (30%) can be spent on ‘Wants’ such as travel or dining out.

- $480 (20%) should be allocated to ‘Savings’ and debt repayment.

To stay on track, John could use budgeting apps or spreadsheets to monitor his spending in each category, making adjustments as needed.

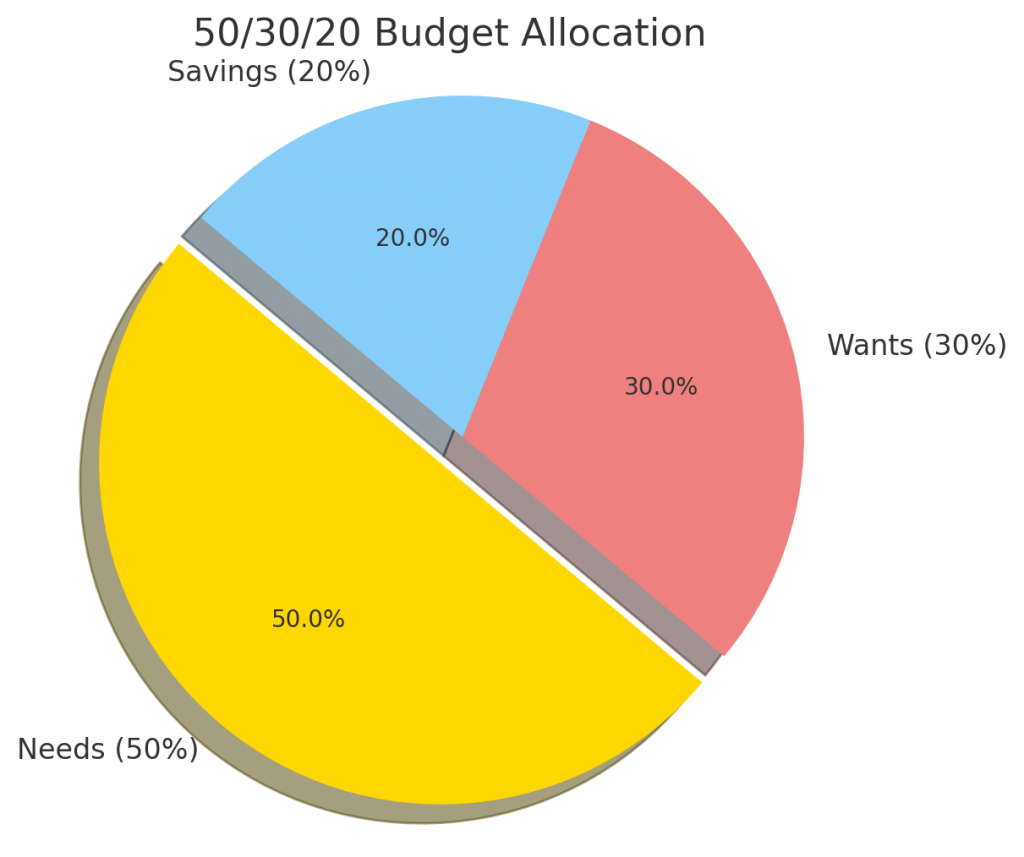

Visualization of Budget Allocation

Let’s visualize an average allocation of the 50/30/20 budget in a pie chart to better understand the distribution of expenses.

Demystifying Common Misconceptions About the 50/30/20 Budget

While the 50/30/20 budget is a popular tool for financial planning, several misconceptions can hinder its effectiveness. Addressing these can help in better understanding and implementing this budgeting rule.

Misconception 1: Rigidity of Categories

- Reality: The 50/30/20 budget is a guideline, not a strict rule. Adjustments can be made based on personal financial goals and circumstances.

Misconception 2: Insufficient for High-Income Earners

- Reality: High-income earners can modify this rule to fit their financial landscape, such as increasing the savings percentage.

Misconception 3: Unsuitable for Low-Income Individuals

- Reality: Those with lower incomes might find the standard allocation challenging, but they can start with smaller savings percentages and gradually increase as their financial situation improves.

Strategies for Overcoming Budgeting Pitfalls

- Track Regularly: Regular monitoring of expenses ensures adherence to the budget.

- Prioritize Financial Goals: Adjust the budget based on short-term and long-term financial objectives.

- Seek Professional Advice: Consulting a financial advisor can provide personalized guidance.

Leveraging Modern Financial Tools

In today’s digital age, numerous apps and online tools can aid in effectively managing the 50/30/20 budget. These tools often come with features like expense tracking, budget alerts, and analytical reports, making it easier to stay on course.

Examples of Popular Budgeting Tools

- Mint: Offers expense tracking and budget planning.

- You Need A Budget (YNAB): Focuses on budgeting and financial education.

- PocketGuard: Helps in tracking expenses and identifying savings opportunities.

Incorporating these tools into your financial planning can simplify the process of adhering to the 50/30/20 budget.

Summarizing the Path to Financial Wellness with the 50/30/20 Budget

The 50/30/20 budget stands out as a practical and adaptable tool for achieving financial health. By dividing income into clear categories of ‘Needs’, ‘Wants’, and ‘Savings’, it provides a structured yet flexible approach to managing personal finances. Whether you’re starting your financial journey or looking to refine your budgeting strategy, the 50/30/20 rule offers a balanced path to financial wellness.

Key Points to Remember

- Adaptability: Customize the budget according to your financial situation and goals.

- Regular Tracking: Use tools and apps to monitor and adjust your spending.

- Financial Discipline: Consistently following this budget fosters a healthier financial lifestyle.

Final Thoughts on the Effectiveness of the 50/30/20 Budget

The 50/30/20 budget is more than just a financial tool; it’s a mindset that encourages a balanced approach to spending and saving. Its simplicity makes it accessible, while its flexibility allows it to be tailored to various income levels and financial goals. Embracing this budget can lead to increased financial awareness, better spending habits, and a more secure financial future.

Actionable Steps for Implementation

- Calculate Your After-Tax Income: Determine your monthly take-home pay.

- Categorize Your Expenses: Identify your ‘Needs’, ‘Wants’, and ‘Savings’.

- Set Financial Goals: Define what you aim to achieve, be it debt reduction, savings increase, or investment growth.

- Use Budgeting Tools: Employ apps and online resources for better tracking and management.

- Review and Adjust Regularly: Make necessary adjustments to align with your changing financial circumstances.

By following these steps, you can embark on a journey towards financial stability and peace of mind, making the 50/30/20 budget a cornerstone of your financial planning.